The post-WWII era is coming to an end. Its most taken for granted institutions, (e.g., the US dollar, NATO, IMF, etc.) and ideologies (globalization, neo-liberalism, etc.) have come under stress, and I take the advent of tea as another sign of the growing Chinese/Asian influence. Such signs can give us an idea-set about one of the directions the world may go into. Our own history, in the western market democracies, that is, gives the complementary directions.

It is not easy to foretell if, let alone how, the world turns Asian. If the capitalist model of growth, based on credit, fiat money and inflation, proves to be irresistible, the Chinese still need to put a lot of work into building up a worldwide financial system, with rules and institutions. This kind of work takes decades and/or catastrophic event(s) to bear fruit. The attractiveness of the Chinese economy in a capitalist scenario consists of its being able to theoretically contain larger bubbles than the rest of world. In fact, the world seems headed into a hyper-capitalist direction where countries assemble in blocs and the individual economic entities grow even more. On its current iteration, the EUro bloc stumbled by being just as resilient as its most exposed economy. If the EUro picks up steam again, the US will have to count its friends and integrate accordingly.

From the western history lessons , one should be reminded, if not told, that market democracies had gone through at least one crisis, similar to the one started in 2008, in the beginning of the 20th century, when the international and national versions of socialism looked like better alternatives to the capitalism that worked for fewer and fewer at the expense of most. Communism and Nazism, those being the two versions of socialism introduced above, had their constituencies even in Britain, still the bastion of capitalism at the time--in fact, there were even top royal British figures flirting with Nazism, while Churchill, the ever ideologically-swinging opportunist, found a vocation in opposing Nazism.

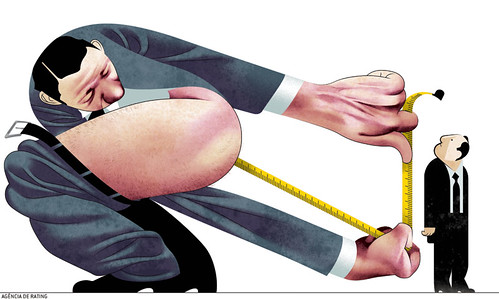

In an economical system predicated on limitless growth, problems on the home front start brewing when the system relegates the willing and educated to un/under-employment. Lack of labor competitiveness can work as justification for only so long before these educated folks give ideological shape to the general dissatisfaction with neo-liberal globalization (e.g., trade liberalization, exchange rate controls, and tax-free flow of money). The western elites (aka 1%) are fully aware of all this, and the never-ending war on terror is just a cover for how far the elites have been willing to go to defend the status qvo ante 2008. Another means to counter the emergence of an opposition to neo-liberal globalization is to quickly consider any alternative as enemy of civilization--you know the usual suspects, extremism, nationalism, socialism, totalitarianism, isolationism, etc.

Also, the S-Ir(i)anian diversions can only take us on collision (or is it collusion?) course with China and Russia. While the Russians have been neatly folded in the world system, and the Chinese have risen within the world system, they show signs of nervousness about their positions relative to the hegemon. Strictly on military terms, the US is still ahead, but otherwise, the defection of Germany and/or Japan to side with the challengers can signal continental shifts. Collision is therefore likely to take place through proxies, whereas collusion would give the challengers first right of refusal over certain places on Earth. Of course, the challengers ought to also face their own internal problems--the Russians have to learn how to live with lowering commodity prices, whereas the Chinese are not anywhere close to having developed a viable growth model/alternative at national scale, let alone planetary scale--but then again, who's gonna call their bluff? The existing credit rating agencies and/or Basel III type of capital requirements... or rather plenty of regional conflicts to the effect of Brzezinskian creative volatility.

To return to the US, the bromides of eventually operating markets, be those economic or political, are wearing thin. In fact, markets are social constructs that need constant oversight under the guidance of whatever socially accepted principles. There is nothing intrinsic to markets that prevents the capitalist excess on its way up or down; markets make only a nice abstraction behind which the few tax the most with impunity. Meanwhile, the US academics, busying as usual with minute correlations, are still to catch up with the enormity of the task. One of the difficulties is the epistemological bias against systemic, or ecological, treatment of the problem. Time for change in the ivory towers will come as the higher-ed bubble may lose some air given the job market difficulties of the ever more indebted graduates. However, Americans overall are catching up--a search by "crisis economics" on Amazon.com yields 57,557 results as of this writing.

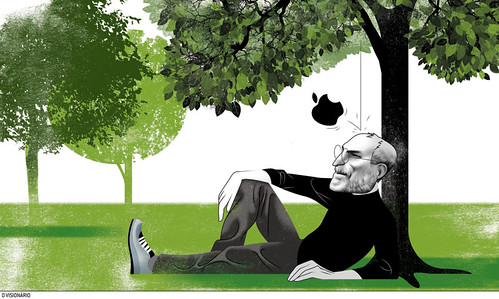

So, what seems sensible to do? The Occupy movements and the libertarians are just too conceptually fragile to make any progress, given how time changes things. A locally verified solution of the capitalist excess would be something akin to the New Deal. Rather than plunge ourselves down the spiral of destitution and despair for not having a Steve Jobs among each fifty-thousand of us, we could stop thinking in terms of labor competitiveness on a global scale for as long as the jobs match the skills and the fruits of labor enable the best of us to take the whole economy to the next level up. Turning a blind eye to the under-educated immigrants can only depress incomes of the locals, preventing most American children from becoming the next Steve Jobs. Also, good healthcare and education ought to be human rights, not a matter of personal income.

Another new deal requires that the American elite adopt a historically informed perspective, which the current generation of leaders is found missing. There are also notable exceptions, such as Felix Rohatyn, of course, of a different generation, whose 2009 book offers a blueprint that's workable within the current system.

| MINQI LI pdf |

Please note that Minqi Li indicates that the planet may not sustain a bubble tea, regardless of the capitalist logic of the global investor.